Introduction

In 2025, foreclosure auctions have quietly become one of the hottest corners of the real estate market. As traditional listings remain scarce and prices stay high, investors are flocking to auctions looking for undervalued opportunities.

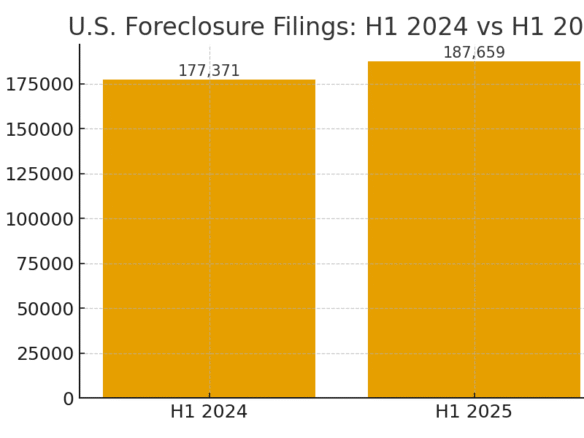

According to ATTOM Data Solutions, U.S. properties with foreclosure filings in the first half of 2025 rose 28% year-over-year, hitting the highest level since 2019.

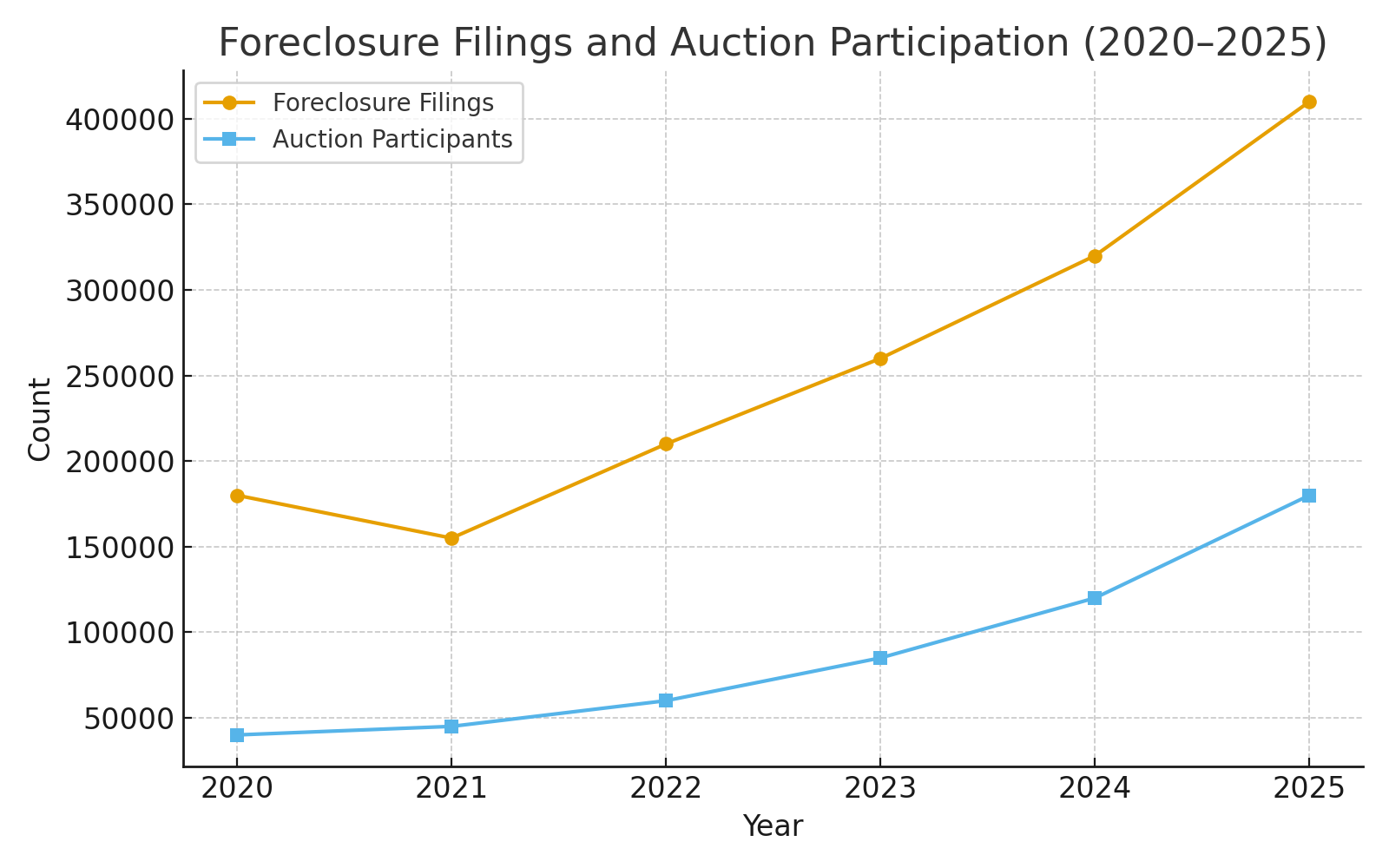

“We’re seeing investor participation double compared to 2022,” says Rick Sharga, CEO of CJ Patrick Company. “Auction activity is a leading indicator that smart money is returning to distressed assets.”

The Perfect Storm Behind the Auction Boom

Several factors are converging to fuel this investor frenzy:

- High mortgage rates — hovering around 6.8%–7.3%, have cooled retail demand.

- Home affordability has fallen to a 40-year low, pushing traditional buyers out.

- Lenders are releasing more distressed inventory after pandemic-era moratoriums expired.

- Technology has democratized access — online platforms like Auction.com, Hubzu, and Xome allow investors to bid from anywhere.

Foreclosure Filings and Auction Participation 2020–2025

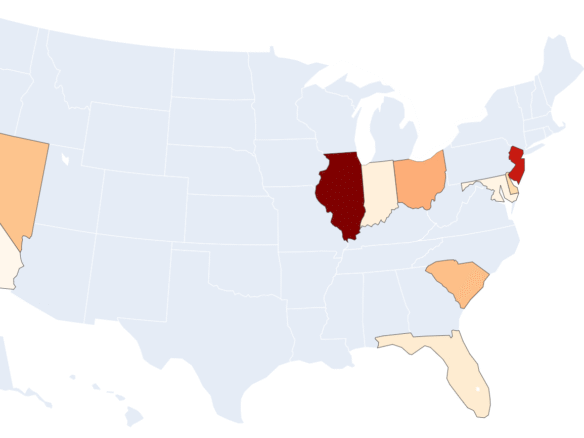

Where Investors Are Buying

Investor demand at auctions is strongest in states where prices have risen fastest since 2020 — but affordability has fallen the hardest.

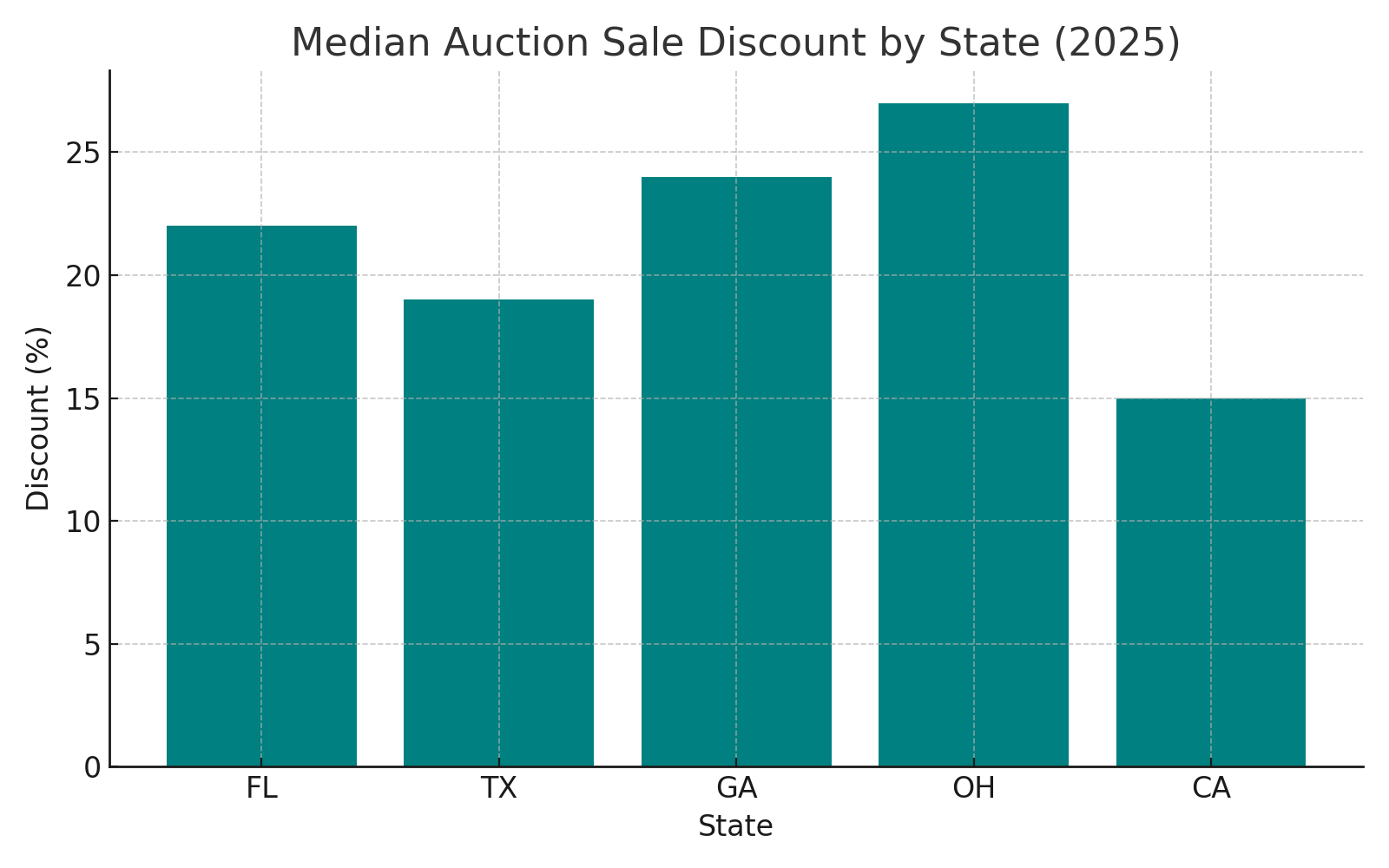

Top 5 States for Auction Activity (Q2 2025):

| Rank | State | Year-over-Year Change | Median Auction Sale Discount |

|---|---|---|---|

| 1 | Florida | +41% | 22% below market |

| 2 | Texas | +33% | 19% below market |

| 3 | Georgia | +29% | 24% below market |

| 4 | Ohio | +25% | 27% below market |

| 5 | California | +22% | 15% below market |

Bar chart comparing median auction discounts by state.

Who’s Buying — and Why

Today’s auction buyers aren’t just hedge funds or institutional investors. Individual investors and small LLCs now represent over 60% of all auction bids in 2025.

Why? Because auction platforms have eliminated many old barriers:

- Clear title data online

- Virtual bidding with instant results

- Financing options for investors

“You don’t need millions to start,” says Lisa Phillips, a real estate coach specializing in distressed properties. “You need knowledge, discipline, and patience — and auctions are perfect for that.”

The Takeaway

With supply tightening and prices still elevated, foreclosure auctions are becoming the new entry point for value-focused investors. Whether flipping or holding rentals, those entering now could be ahead of the next cycle.

Sources

- ATTOM Data Solutions (2025 Midyear Foreclosure Report)

- Black Knight Mortgage Monitor (May 2025)

- CJ Patrick & Co. Market Brief (June 2025)

- CoreLogic Housing Market Insights (Q2 2025)

Join The Discussion