Introduction

Every time the Federal Reserve lowers its benchmark rate, the ripples travel across mortgages, borrowing costs and asset-pricing. In 2025, as the Fed begins to ease its tightening cycle, the implications for the residential and commercial property markets are significant — and especially for the niche world of real-estate auctions. For investors, this moment offers a strategic window of opportunity.

1. What the Fed Did & Why It Matters

In October, the Fed cut its federal-funds target range by 0.25 percentage points to 4.00-4.25%, marking the first reduction since late 2024. FortuneBuilders

While the Fed doesn’t directly set mortgage rates, its decision tends to influence Treasury yields, which in turn affect mortgage and commercial loan pricing. 208.properties

Why Auctions Are Triggered by Rate Cuts

Lower interest rates affect auctions in multiple ways:

- Borrowing costs fall → bidders (especially investors) get improved financing terms.

- Refinancing activity rises → owners under stress may sell or be forced into auctions.

- Valuation pressure eases → cap-rate compression means more aggressive bidding at auctions.

- Secondary markets heat up → improved liquidity encourages more participation in distressed auctions.

2. Current Real Estate Market Snapshot & Auction Implications

Housing Affordability, Supply & Demand

Mortgage rates have begun to move lower; for example, the 30-year fixed dipped to ~6.77% in June 2025, as markets anticipated Fed easing. MarketWatch

Low inventory and deferred maintenance in older portfolios mean auctions may gather higher-quality listings than in past cycles.

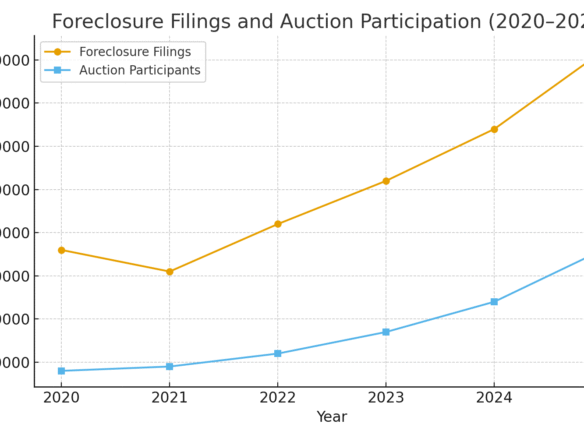

Distressed & Auction Activity

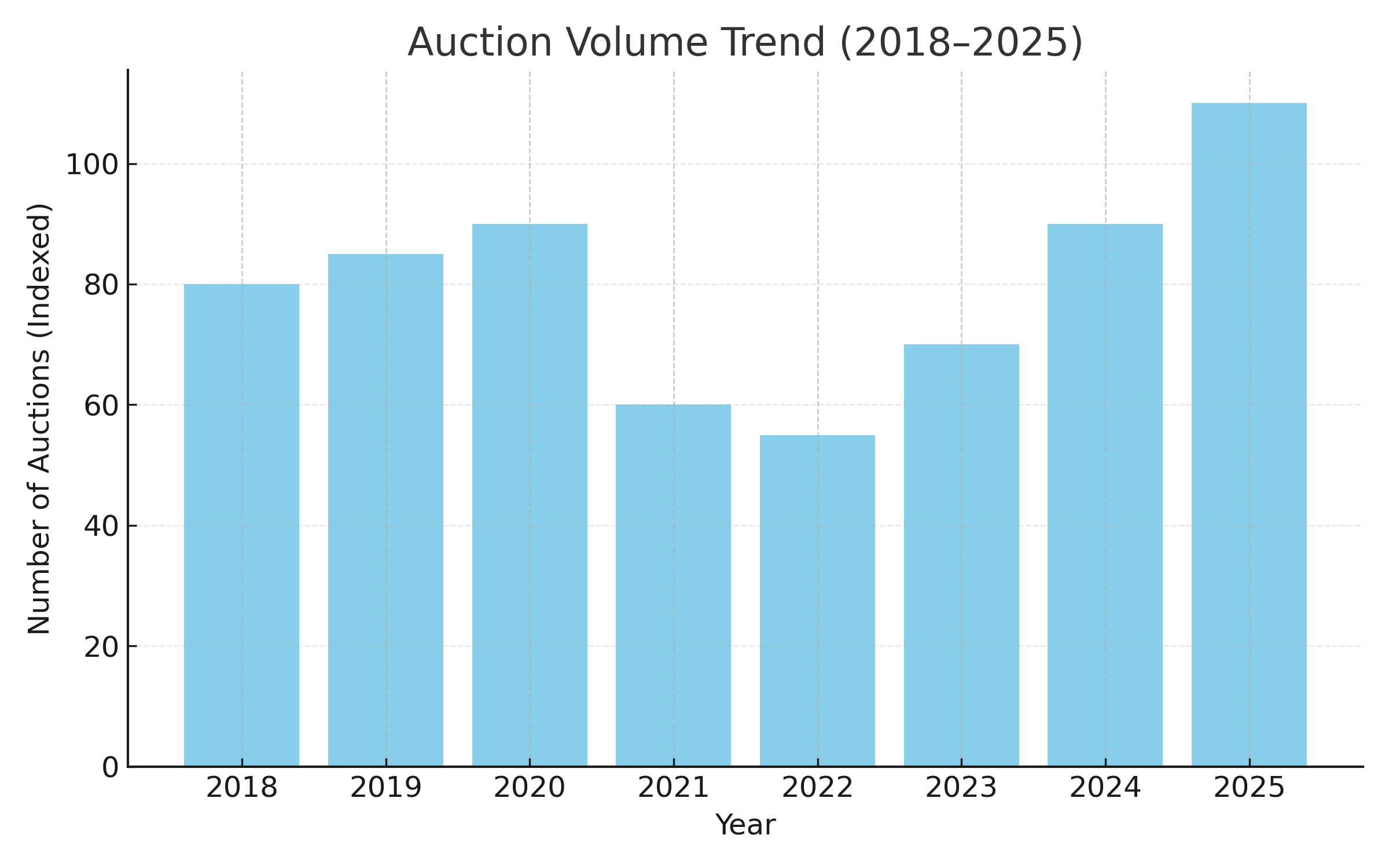

While not yet exploded, auction volume often accelerates after rate cuts as market participants anticipate resurgent demand and refinancing relief. Historical data suggests a 6-12 month lag post-rate cut before major price appreciation and increased auction competition. 208.properties

3. What This Means for Real-Estate Auctions in 2025

For Sellers & Asset Owners

Sellers considering auctions should act now: lower rates improve conditions, and moving earlier may secure better sale outcomes before a full-blown bidding surge.

For Buyers & Investors

Key strategies include:

- Lock in financing early — even floating or bridge loans may become cheaper.

- Gauge markets where supply is tight but auctions still yield discounts.

- Monitor cap-rate softening as lower rates compress yield expectations.

Risk Factors to Watch

- Mortgage rates may not drop immediately — markets often lag the Fed.

- Oversupply or local economic decline can counteract rate benefits.

- If inflation rebounds, the Fed may pause or reverse cuts, disrupting the momentum.

4. Putting It All Together — Tactical Steps

Step 1: Ready Your Capital

Ensure liquidity or line of credit is in place — timing matters.

Step 2: Market Selection

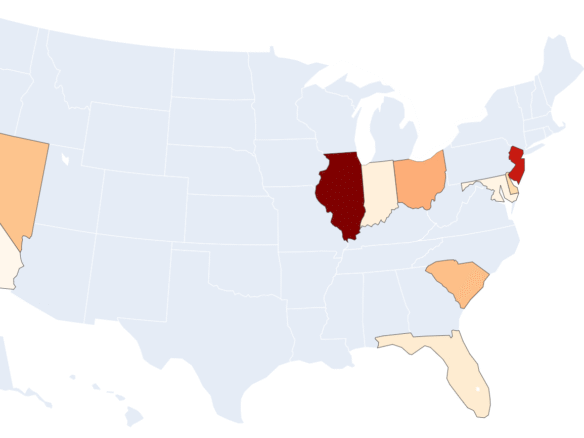

Focus on metros with strong fundamentals (jobs, migration) + meaningful discount spreads at auction.

Step 3: Underwrite for Low-Rate Environment

Assume borrowing costs drop, cap rates tighten, and competition intensifies.

Step 4: Monitor Leading Indicators

Keep an eye on:

- 10-year Treasury yield movement

- Auction registration volumes

- Default/foreclosure filing trends

5. Outlook

With the Fed’s easing path likely to continue in late 2025, the conditions are favorable for a resurgence in auction activity. We may see a “sweet-spot” window — where borrowing costs fall and competition remains moderate — before the market fully accelerates. Auction-savvy investors who position ahead of the crowd stand to gain. However, the delayed response time and local market variation mean staying flexible and data-driven remains key.

References

- Than Merrill, “Interest Rate Cuts and What They Mean for Real Estate Investors”, FortuneBuilders (Sep 2025). FortuneBuilders

- “The Fed makes a second interest rate cut. Here’s what will — and won’t — change for your money.” Bankrate, Oct 2025. Bankrate

- “How Fed Rate Cuts Impact Real Estate Investors, Developers and Owners.” Grassi Advisors, Oct 6 2025. Grassi

- “Real Estate Price Trends Post-Fed Cuts: A Historical Guide for Real Estate Investors.” 208.Properties Blog, Aug 4 2025. 208.properties

Join The Discussion